Karane Enterprises A Calendar-Year Manufacturer 2026 Spectacular Breathtaking Splendid

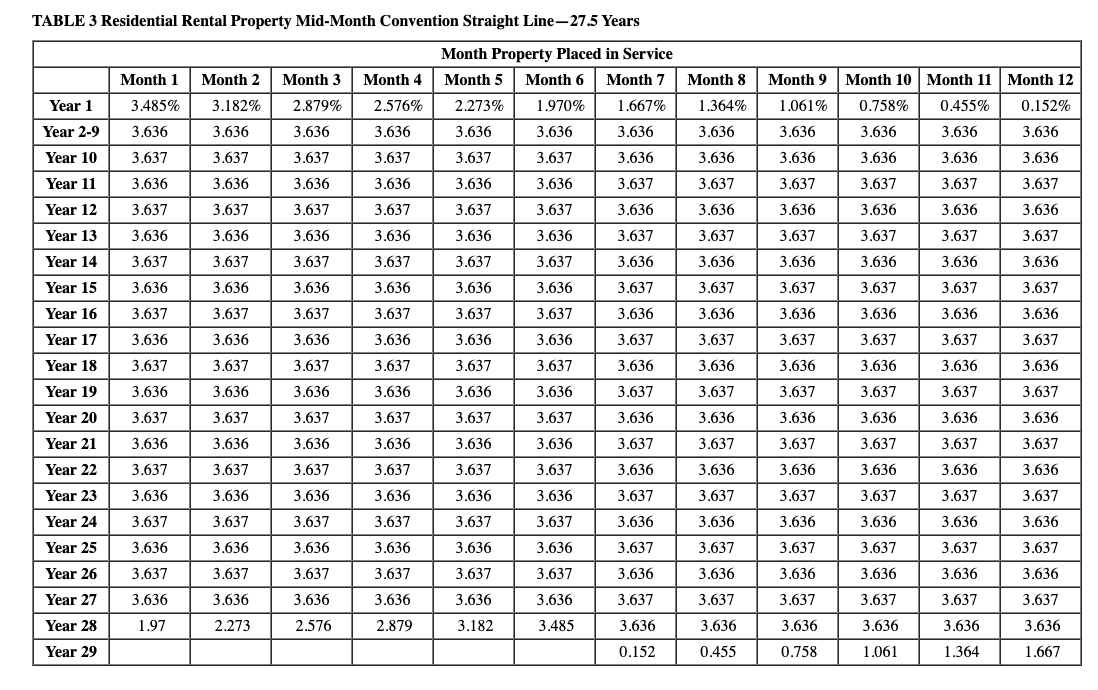

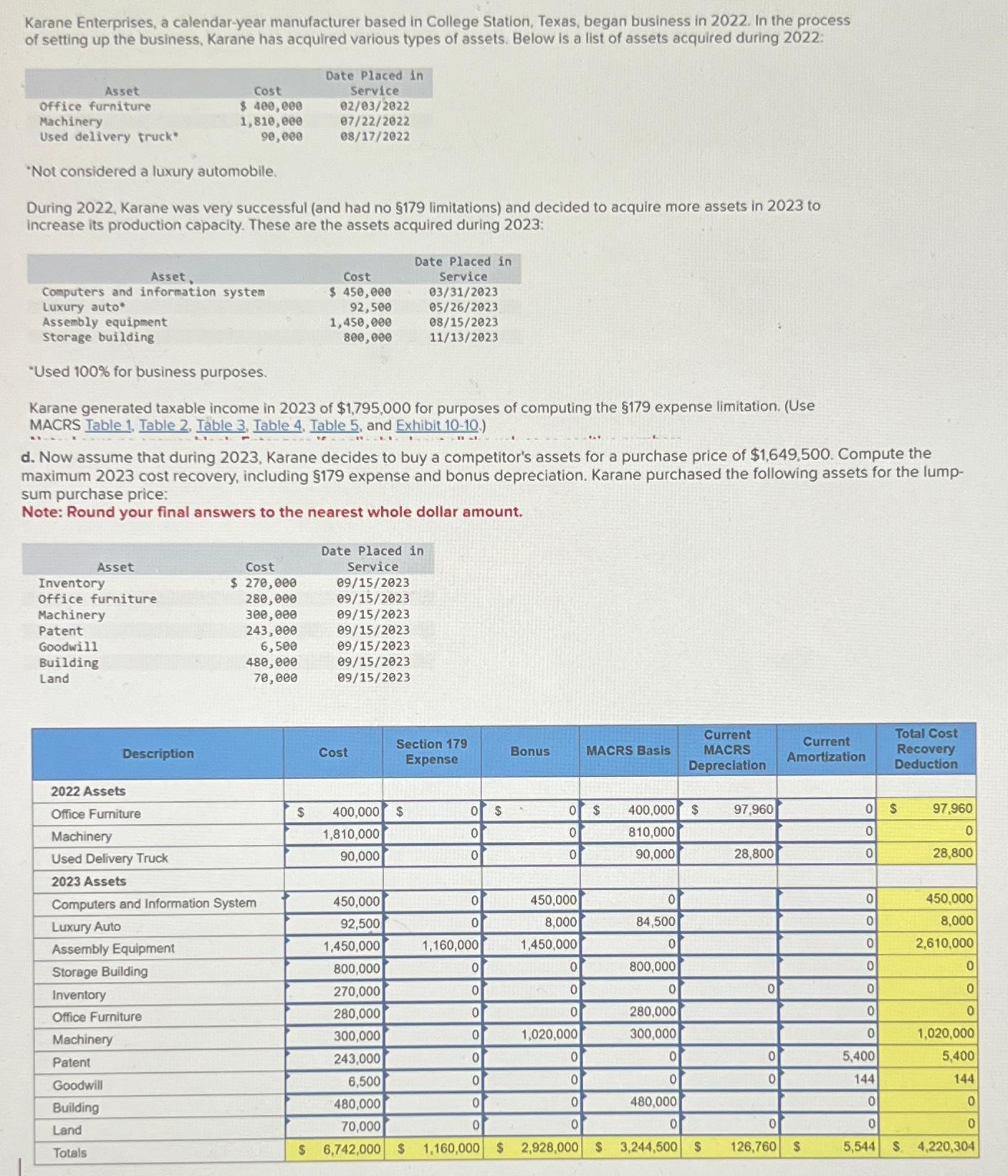

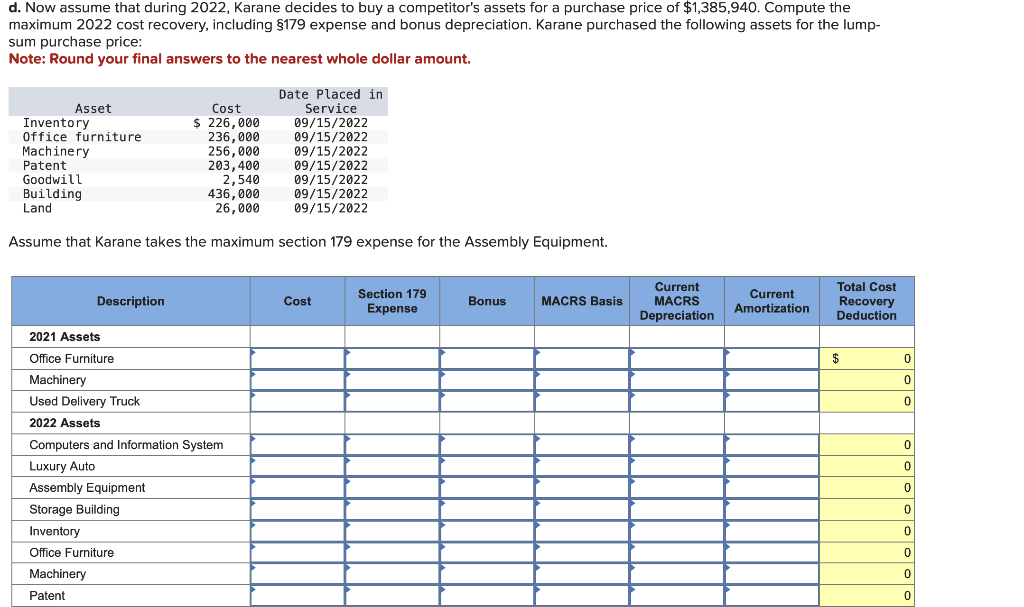

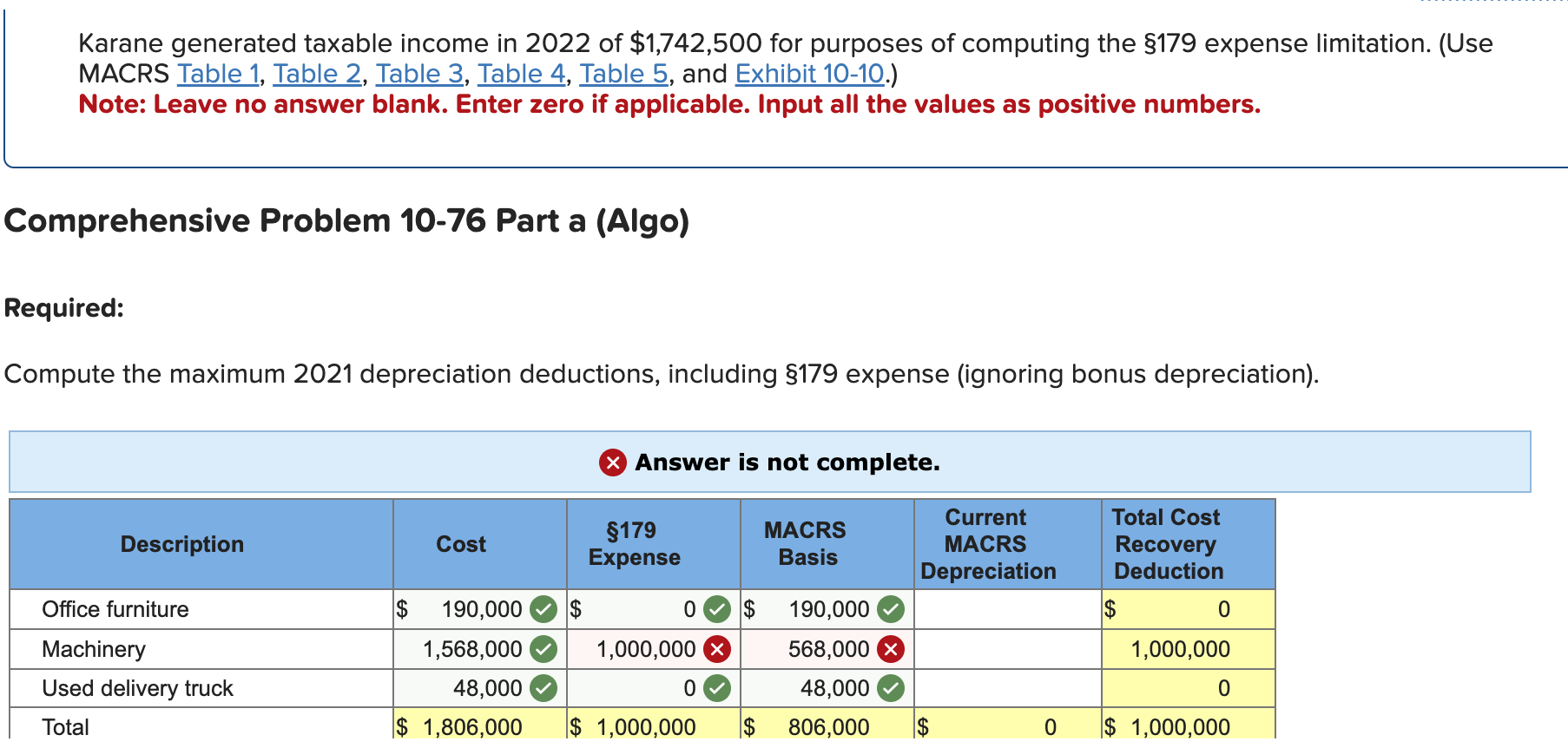

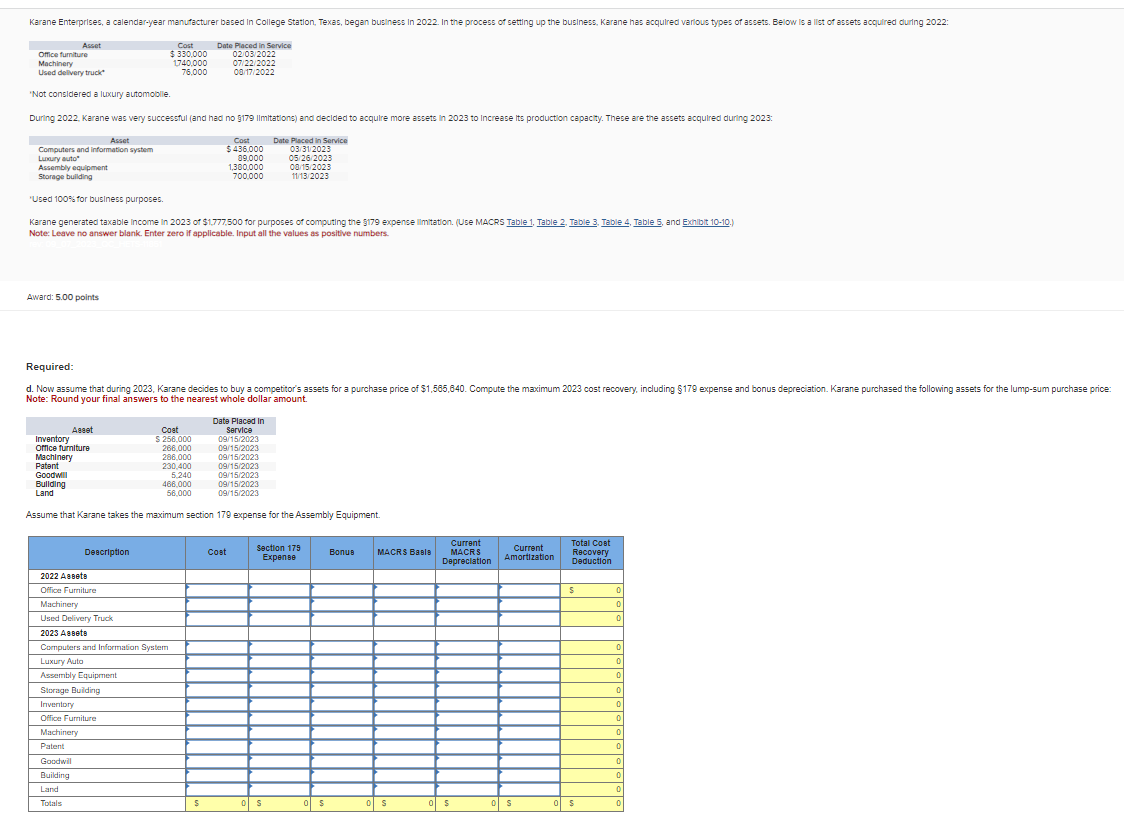

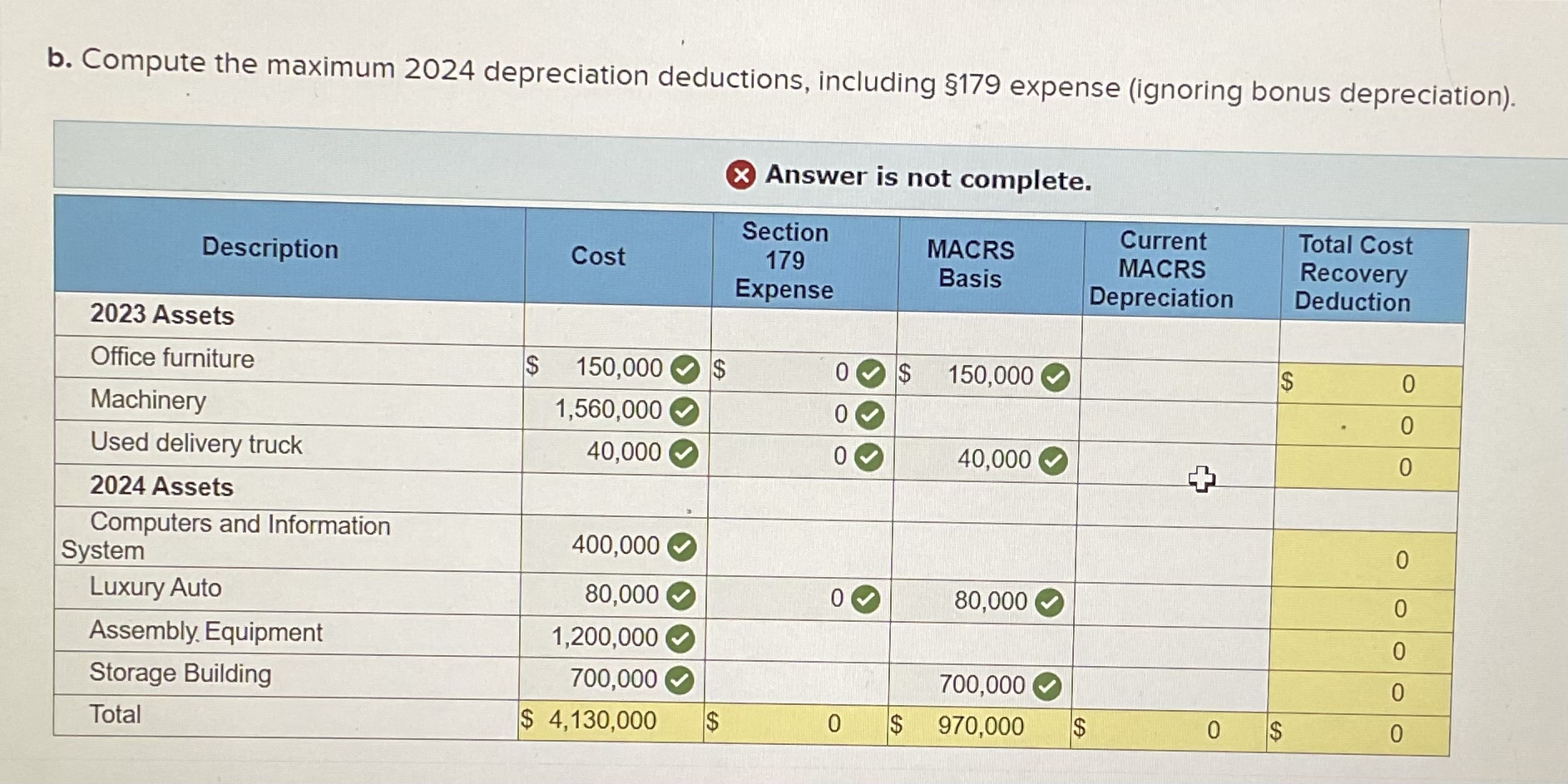

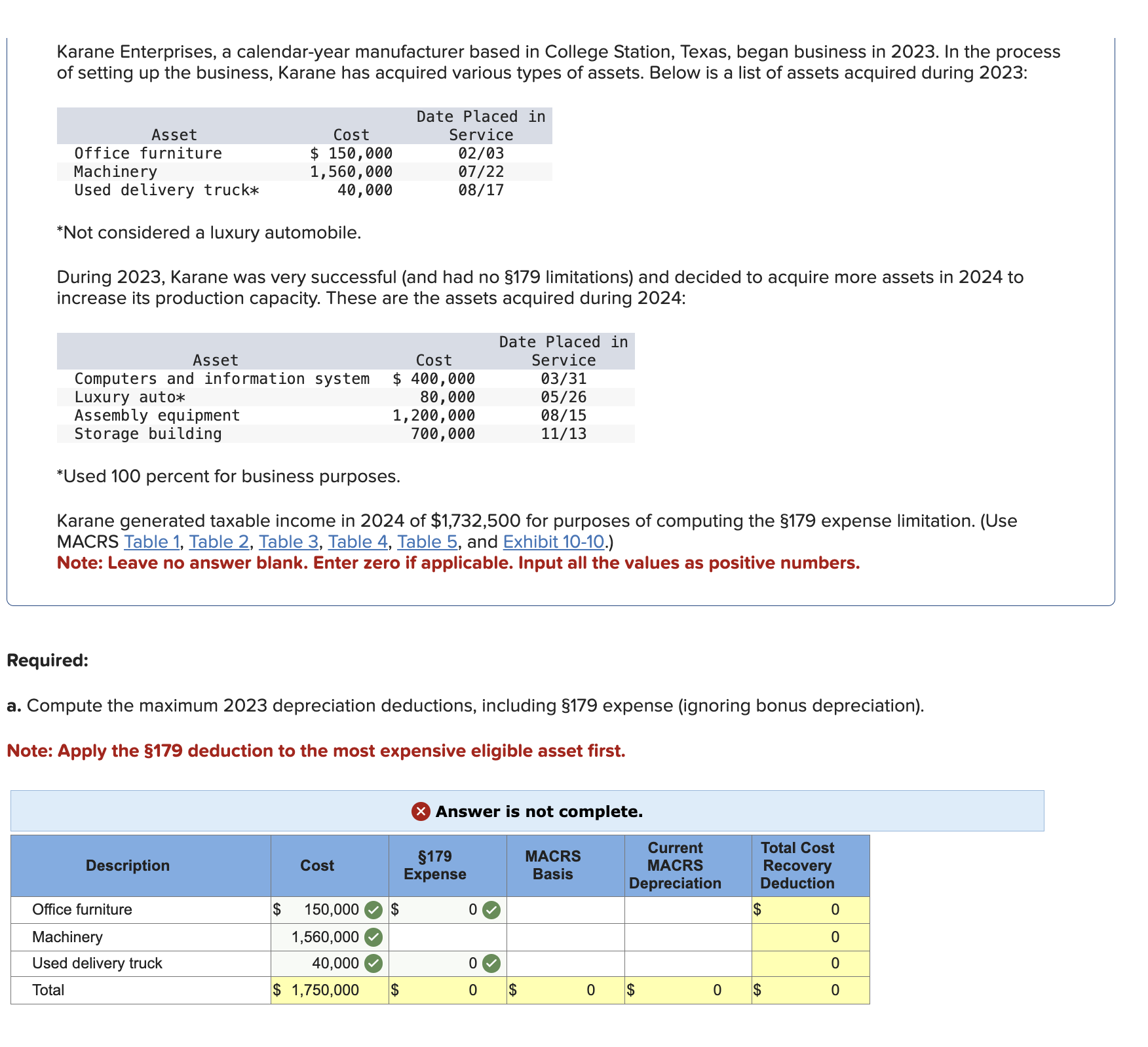

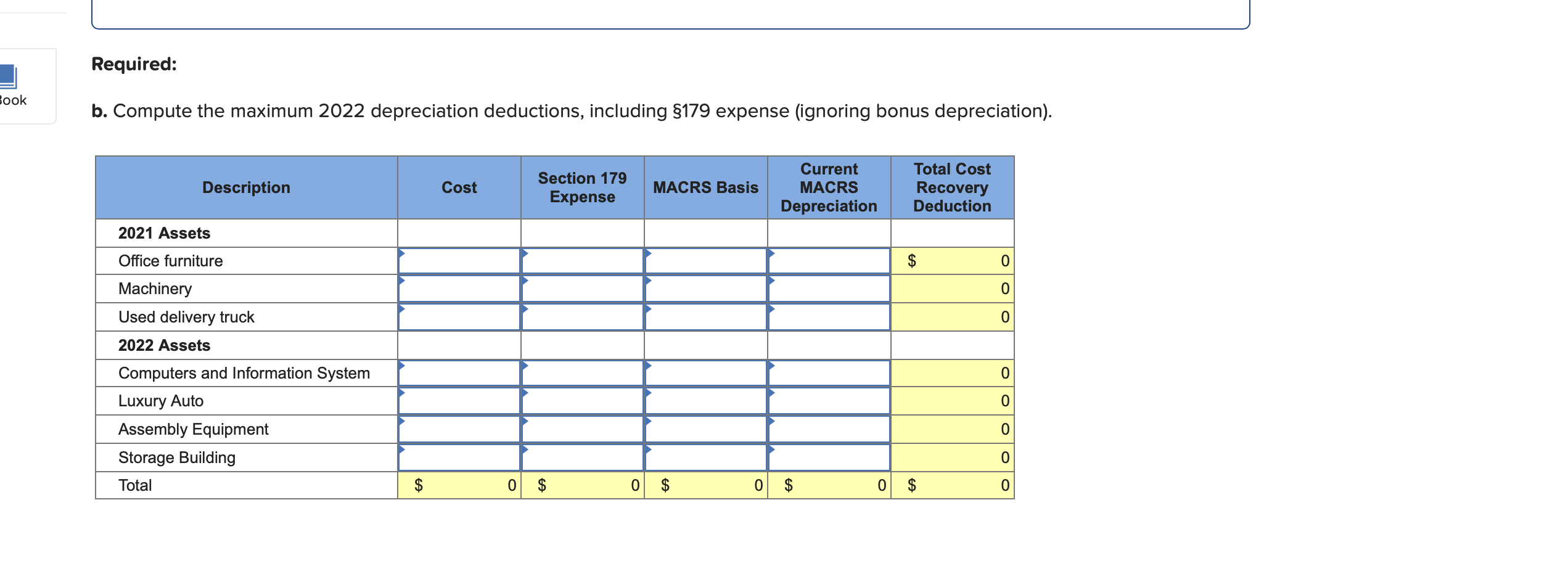

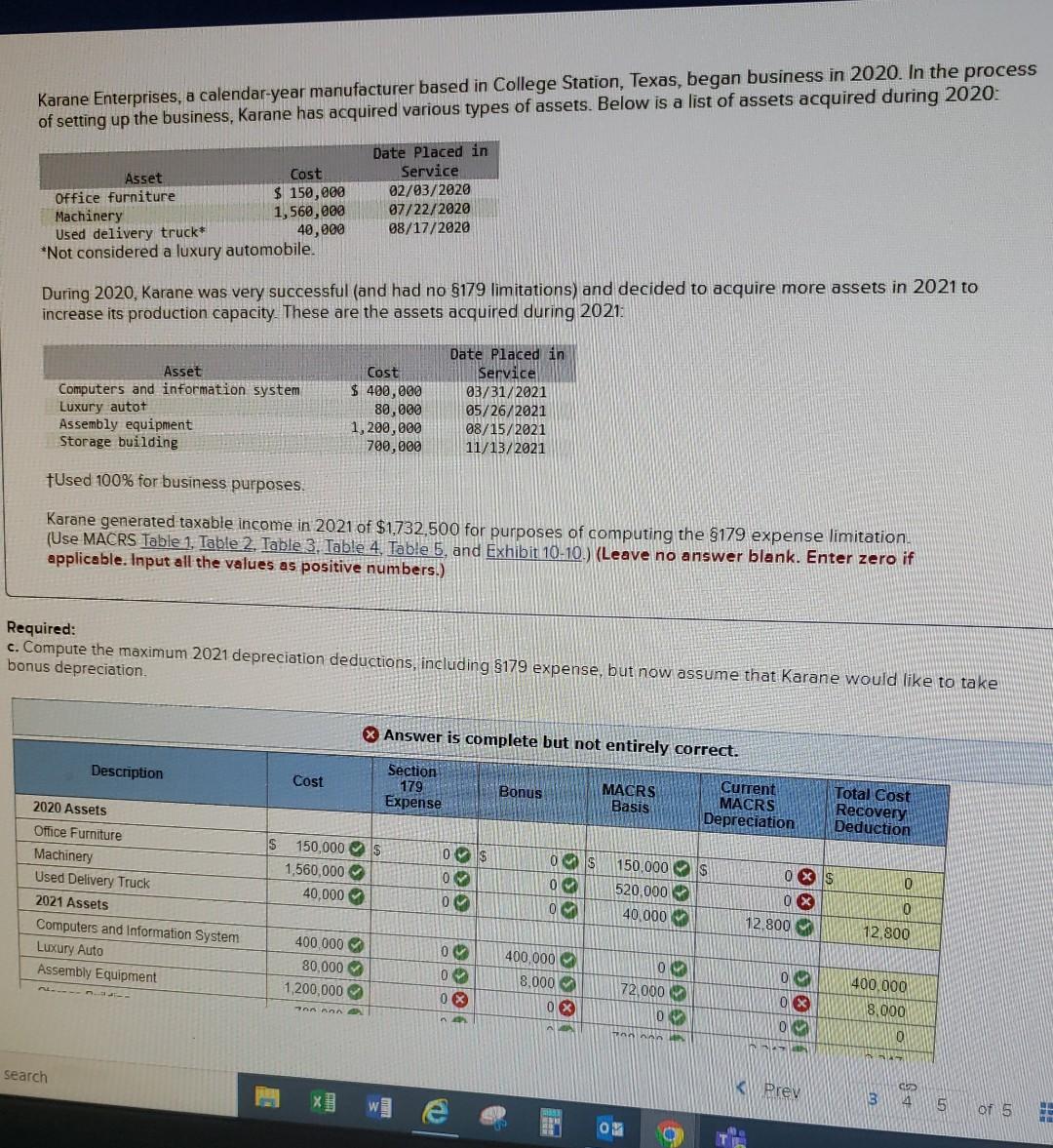

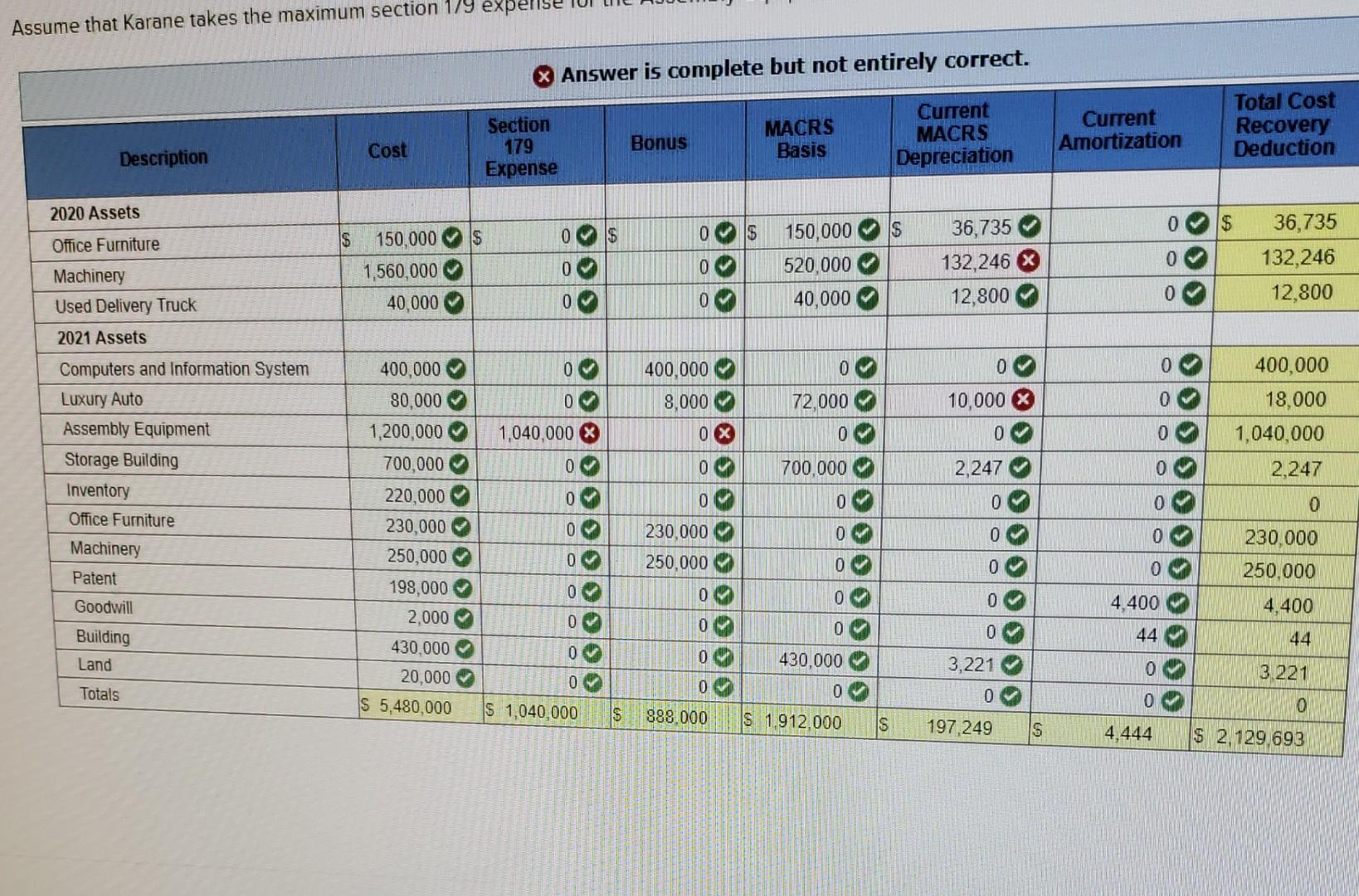

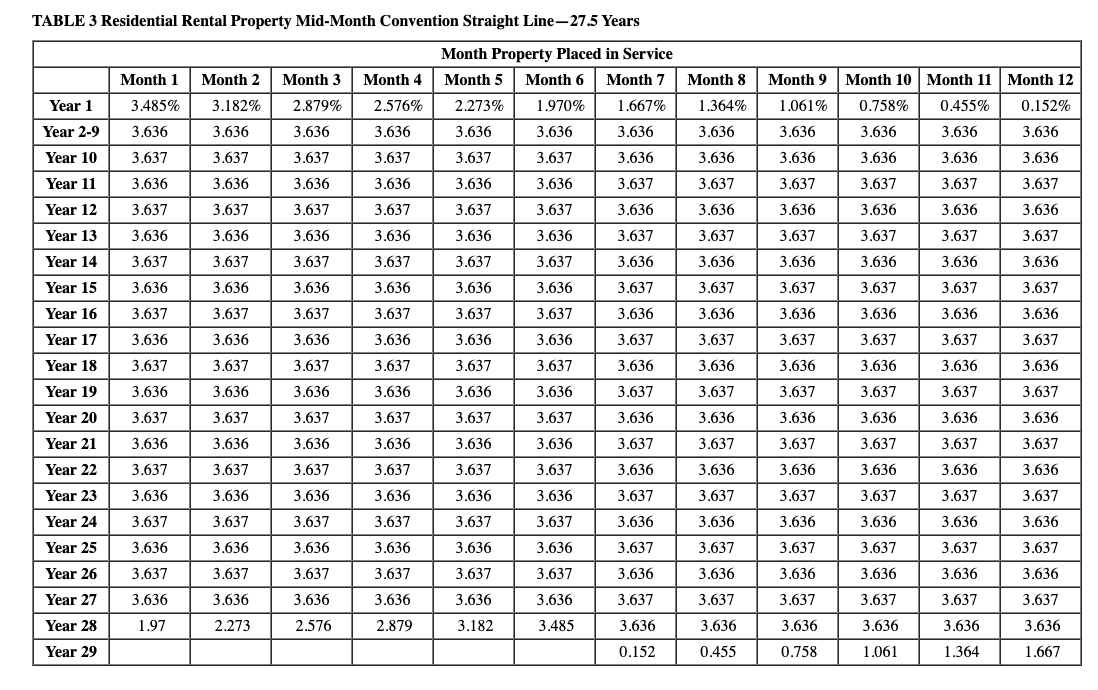

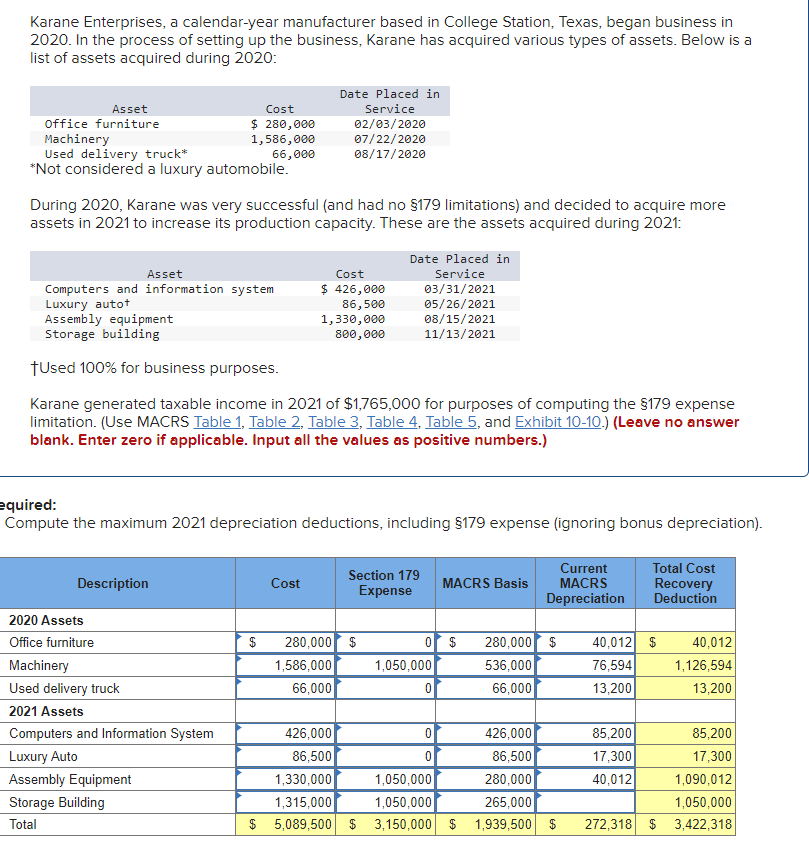

Karane Enterprises A Calendar-Year Manufacturer 2026 Spectacular Breathtaking Splendid. In the process of setting up the business,. For karane enterprises' taxable income of $1,762,500 in 2023 for computing the §179 expense limitation, you will need to factor in these depreciation.

To compute the maximum 2023 depreciation deductions for karane enterprises, including §179 expense and bonus depreciation, we will follow. In the process of setting up the business,. In the process of setting up the business, karane has acquired various types of assets.

Source: www.chegg.com

Source: www.chegg.com

Karane Enterprises, a calendaryear manufacturer In the process of setting up the business,. Discuss the process of setting up a business and the importance of acquiring various types of assets.

Karane Enterprises, a calendaryear manufacturer Discuss the process of setting up a business and the importance of acquiring various types of assets. To compute the maximum 2023 cost recovery for karane enterprises, including section 179 expense and bonus depreciation, we need to follow these.

Karane Enterprises, a calendaryear manufacturer In the process of setting up the business, karane has acquired various types of assets. To compute the maximum 2023 cost recovery for karane enterprises, including section 179 expense and bonus depreciation, we need to follow these.

Solved Karane Enterprises, a calendaryear manufacturer Explain the concept of §179 limitations and how it. Discuss the process of setting up a business and the importance of acquiring various types of assets.

Source: margotgrace.pages.dev

Karane Enterprises A CalendarYear Manufacturer 2025 Margot Grace Discuss the process of setting up a business and the importance of acquiring various types of assets. In the process of setting up the business,.

Solved Karane Enterprises, a calendaryear manufacturer To compute the maximum 2023 cost recovery for karane enterprises, including section 179 expense and bonus depreciation, we need to follow these. In the process of setting up the business,.

Source: www.chegg.com

Source: www.chegg.com

Solved Karane Enterprises, a calendaryear manufacturer To compute the maximum 2023 cost recovery for karane enterprises, including section 179 expense and bonus depreciation, we need to follow these. Explain the concept of §179 limitations and how it.

Solved Karane Enterprises, a calendaryear manufacturer In the process of setting up the business,. In the process of setting up the business, karane has acquired various types of assets.

Source: www.chegg.com

Source: www.chegg.com

Solved Karane Enterprises, a calendaryear manufacturer In the process of setting up the business,. In the process of setting up the business,.

Source: www.chegg.com

Source: www.chegg.com

Karane Enterprises, a calendaryear manufacturer For karane enterprises' taxable income of $1,762,500 in 2023 for computing the §179 expense limitation, you will need to factor in these depreciation. Discuss the process of setting up a business and the importance of acquiring various types of assets.

Solved Karane Enterprises, a calendaryear manufacturer In the process of setting up the business,. To compute the maximum 2023 cost recovery for karane enterprises, including section 179 expense and bonus depreciation, we need to follow these.

Solved Karane Enterprises, a calendaryear manufacturer In the process of setting up the business,. Explain the concept of §179 limitations and how it.